Contributions to SIPP schemes

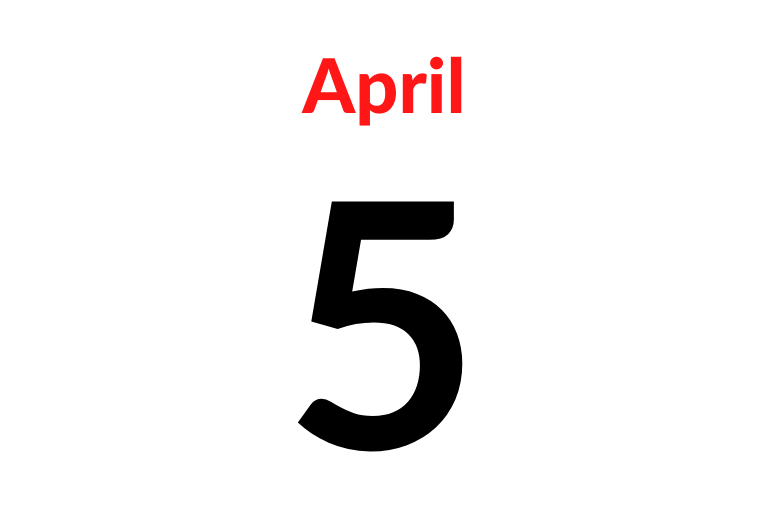

The last date to submit new SIPP applications and contributions to us for the 2021/22 tax year is Tuesday 5th April 2022.

Note that as our SIPPs have individual bank accounts, contributions must be paid directly to the correct individual account and include the SIPP number as the reference. If you are unsure as to the correct bank account details to use, please phone us on 01228 538 988 and ask for the SIPP Accounts Team.

For existing SIPP members, we will need a new signed Supplementary Contribution Application to accompany the contribution, this can be downloaded from our website and should be sent by email to: [email protected] (or by post to InvestAcc Pension Administration Limited, Minerva House, Port Road Business Park, Carlisle, CA2 7AF or by fax to 01228 535 988).

For new SIPP schemes, we will need a fully completed new SIPP Application which can be sent to us by email to: [email protected] or by post or fax using the contact details above. You should follow that up with a phone call to confirm receipt and to request the payment details, if making a last minute contribution.

Any contributions paid electronically after close of business on Tuesday 5th April 2022 will be treated as received on 6th April 2022, in the new tax year.

Contributions to SSAS schemes

For anyone wishing to establish a new SSAS, bear in mind that the various processes can take some weeks to complete, including obtaining confirmation of registered status from HMRC. If you wish to establish a new SSAS and to pay contributions before the end of the current tax year, please contact our SSAS team on 01228 538 988 to discuss this.

For existing SSAS schemes, contributions can be paid to the trustee bank account – please also provide confirmation to [email protected] that the contributions have been made, the specific amounts for each member, and whether they are from the employer or personal contributions.

March 1st, 2022